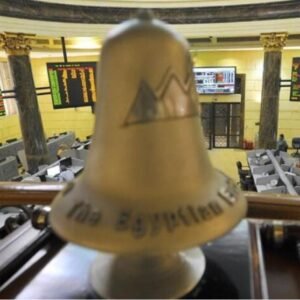

Gold prices fell by 185 Egyptian pounds in one week.

This coincided with a decrease in the price of an ounce of gold on the global stock exchange by approximately 4.4%.

The gold and jewelry market in Egypt

Gold prices witnessed a decline of 185 pounds during last week's trading, with a decrease of about 5%, coinciding with a decrease in the price of an ounce on the global stock exchange by about 4.4%, affected by price fluctuations and profit-taking operations, according to a report issued by the iSagha online gold and jewelry trading platform.

Saeed Embaby, the platform's CEO, said that the price of a gram of 21-karat gold opened trading at 6,075 Egyptian pounds, before falling to 5,890 pounds by the end of the week.

Globally, gold prices fell by about $201 per ounce, starting trading at $4,533 and closing at $4,332, after reaching a historic high of $4,555 per ounce.

Embaby explained that a gram of 24-karat gold recorded about 6731 pounds, while the price of a gram of 18-karat gold reached about 5049 pounds, while the gold pound recorded about 47120 pounds.

Markets are expected to see strong movements when trading resumes tomorrow, amid escalating tensions between the United States and Venezuela, following reports of military escalation and political and security unrest in Caracas.

Regarding future projections, Goldman Sachs' commodities team presented one of the most optimistic scenarios, predicting that gold will reach $4,900 an ounce by the end of 2026, supported by strong purchases from central banks estimated at around 70 tons per month, along with a possible reduction in US interest rates that would boost demand for gold funds.

In contrast, JPMorgan expects a more aggressive rise, predicting that gold will reach around $5,055 an ounce by the last quarter of 2026.

In contrast, Goldman Sachs expects continued pressure on oil prices, estimating the average price of Brent crude at $56 per barrel, given the global supply glut and OPEC's reluctance to cut production sharply, unless major geopolitical shocks occur.

This contrast between the strength of gold and the weakness of oil reflects the magnitude of the expected macroeconomic risks during 2026, especially those related to inflation and energy market shifts. Meanwhile, analysts at Morgan Stanley and JPMorgan believe that the path of US interest rates will remain the decisive factor in asset performance during the coming year, with expectations of a decline in returns in the first half of 2026, followed by their stabilization later as inflation data stabilizes.