News

عقد الدكتور مصطفى مدبولي، رئيس مجلس الوزراء، مساء اليوم، بمقر الحكومة بالعاصمة الجديدة، اجتماعًا لاستعراض التقديرات الأولية لمشروع موازنة العام...

-

-

16 February 2026

عقد الدكتور مُصطفى مدبولي، رئيس مجلس الوزراء اجتماعاً، اليوم ، لبحث فرص وآفاق توطين صناعة السيارات محلياً، وزيادة تنافسية المناطق...

-

-

27 January 2026

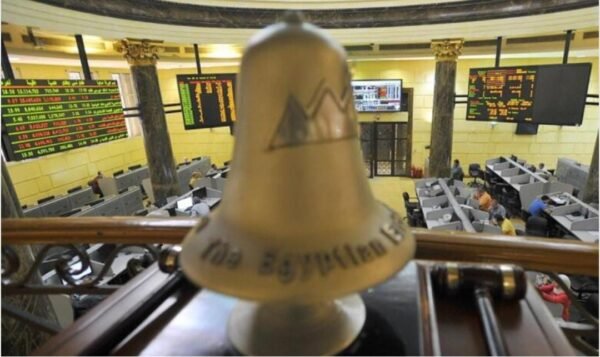

ربح رأس المال السوقي لأسهم الشركات المقيدة بالبورصة المصرية نحو 14 مليار جنيه بنهاية تعاملات اليوم ، الاثنين، ليبلغ مستوى...

-

-

26 January 2026

حققت البورصة المصرية مكاسب سوقية بلغت نحو 180 مليار جنيه خلال تعاملات الأسبوع الماضي ، ليصل رأس المال السوقي إلى...

-

-

24 January 2026

رياض : البنك الأهلي المصري يستهدف زيادة محفظة التمويل المستدام بنسبة 10% سنويًا حتى 2027 بما يعكس التزامه الراسخ بدعم...

-

-

22 January 2026

وكيل محافظ البنك المركزي: ارتفاع معدلات الشمول المالي بمصر إلى 77.4% تمويلات البنوك للمشروعات الصغيرة والمتوسطة و”المتناهية” تتجاوز 600 مليار...

-

-

19 January 2026

التقى حسن الخطيب، وزير الاستثمار والتجارة الخارجية، أشرف عمر، الرئيس التنفيذي لمجموعة Brandix للمنسوجات والملابس الجاهزة، حيث استعرض اللقاء خطط...

-

-

January 18, 2026

عقد محمد الجوسقي، الرئيس التنفيذي للهيئة العامة للاستثمار والمناطق الحرة، مائدة مستديرة مع وفد رفيع المستوى من الشركات العاملة في...

-

-

17 January 2026

قال حسن الخطيب وزير الاستثمار والتجارة الخارجية إن الدولة تتبنى نهجًا إصلاحيًا يقوم على وضوح السياسات الاقتصادية واستدامتها، مؤكدا أن...

-

-

15 January 2026

كشف حسن الخطيب، وزير الاستثمار والتجارة الخارجية عن إطلاق منصة رقمية تضم 389 ترخيصاً، بالإضافة إلى التعاقد مع استشاريين لتطوير...

-

-

13 January 2026

أكد محمد صلاح الدين مصطفى وزير الدولة للإنتاج الحربي، حرص الوزارة على جذب المزيد من الاستثمارات وعقد شراكات تعاونية جديدة...

-

-

12 January 2026

رئيس الوزراء : مصر دخلت عصر تجميع وإنتاج مكونات الطاقة الشمسية في تصريحات لمدبولي عقب انتهاء جولته الموسعة لافتتاح عدد...

-

-

11 January 2026