The Federal Open Market Committee kept US interest rates at the same levels unchanged.

This happens for the sixth meeting in a row.

Conclusions about the US interest rate decision

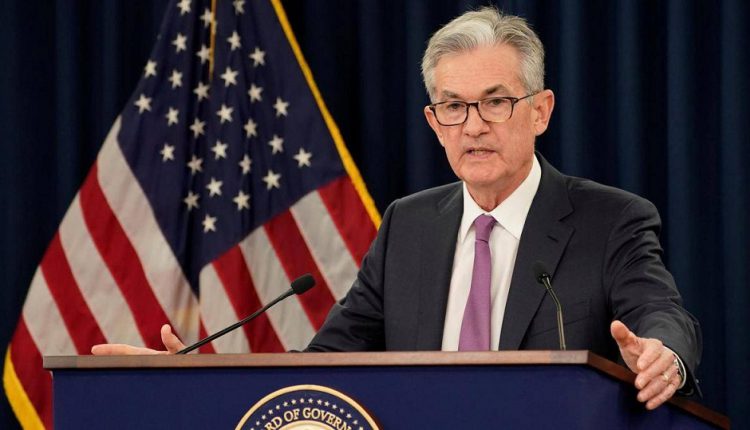

Below are the most prominent conclusions from the Federal Open Market Committee's interest rate decision and Federal Reserve Chairman Jerome Powell's press conference on Wednesday:

Maintaining interest rates

- The Federal Open Market Committee kept US interest rates unchanged for the sixth consecutive meeting.

- Powell said it will take longer than expected to gain confidence about inflation returning to the Fed's target of 2%.

- He essentially ruled out cutting interest rates in the near term.

- “We can be patient,” he added.

- His comments therefore appear to close the door on the possibility of a rate hike as well.

Monetary policy is now constrained

- Powell said monetary policy is now constrained.

- He added that over time it will be restrained enough to bring inflation back to target.

- He declined to estimate the extent of the possibility of interest rate cuts this year.

- He also added that monetary policy needs more time to succeed.

- The president said that the data will be the key to determining when to cut rates.

- The FOMC is still aiming for a soft landing.

- The committee said that the risks threatening the achievement of employment and inflation targets moved towards a better balance during the past year.

- Powell also said that with inflation declining over the course of the year, there is now greater focus on a full employment mandate.

- He noted that the Federal Reserve does not target wages.

- The Federal Reserve announced that it will slow the pace of quantitative tightening starting June 1.

- The above cuts the maximum amount of Treasuries allowed to expire without renewal on the balance sheet by more than half, to $25 billion per month from $60 billion.

- Officials have maintained the pace of disposal of mortgage-backed securities at a maximum of $35 billion per month.

- Powell has said there is no indication here about policy.

- The S&P 500 rose 1%, erasing earlier losses.

- Treasuries also rose, as the Federal Reserve agreed to slow the reduction in its bond portfolio.

- Two-year US Treasury yields also fell below 5%, as swap traders increased their bets on interest rate cuts, anticipating higher odds that the first cut would be in November, rather than December.